“Unfortunately, these parts cannot be delivered at the moment.”

“It is likely that we will have to reduce production due to the gas shortage.”

“We have to take the impact of the new Covid-19 variant into account when planning our workforce.”

Do you recognize at least one of these challenges? Exogenous shocks like these occur at ever shorter intervals and have transboundary effects on us personally and many companies. The strategy here is not very recommendable: wait and see. Rather, companies must be able to quickly assess the extent of the crisis in question in order to be able to limit the damage or identify opportunities and thus get crises under control. However, many companies do not have the relevant information at all, or analyzes take so long that they are already out of date when they are presented to the decision-makers.

How does the crisis affect my sales targets, liquidity and production plans?

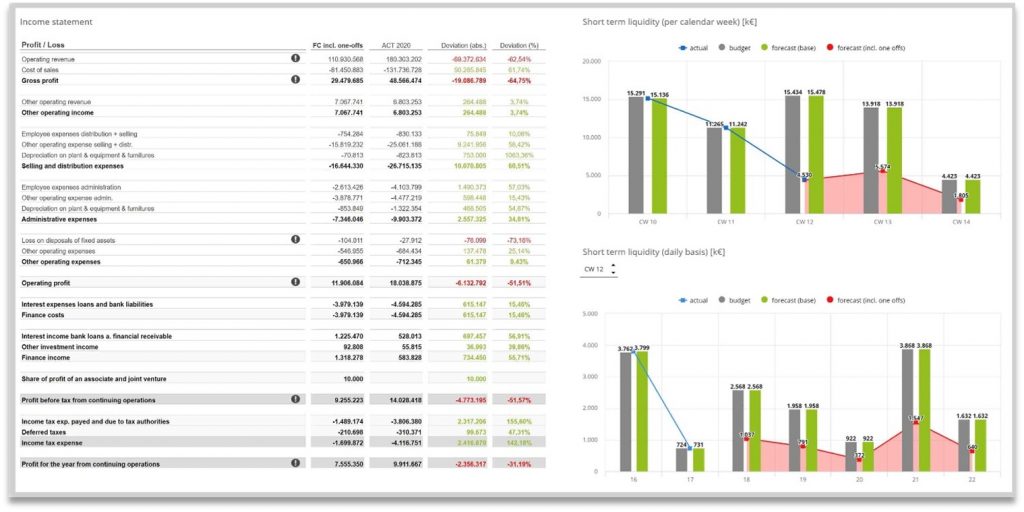

From the management’s point of view, these questions are essential and must be answered quickly. Only then can the right decisions be made proactively. This is where the controlling department comes into play as a business partner of the management. Ideally, controllers would provide support using a professional CPM & BI controlling system using scenario analyses. Based on current company data and taking into account external factors, the effects of the crisis on the company’s results can be simulated and timely initiatives can be taken. At an aggregated level or at a detailed level (drill-down and drill-through), all of the decision-makers’ questions can be answered on a daily basis with just a few clicks. Meaningful, standardized analyses, KPI, forecasts and clear reports are accessible to all those responsible and can be edited in Excel-like spreadsheets or dashboards.

You can find more information and a short video how to get crises under control on our crisis controlling knowledge platform >>

7 concrete steps how management can be supported by a networked controlling system and get crises under control

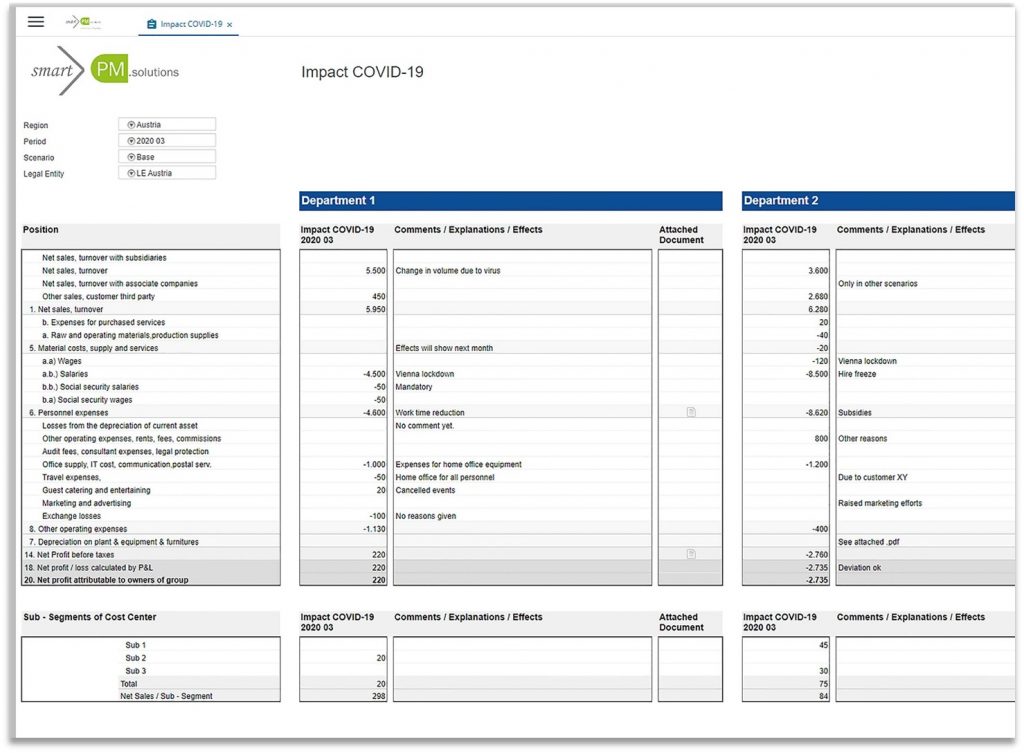

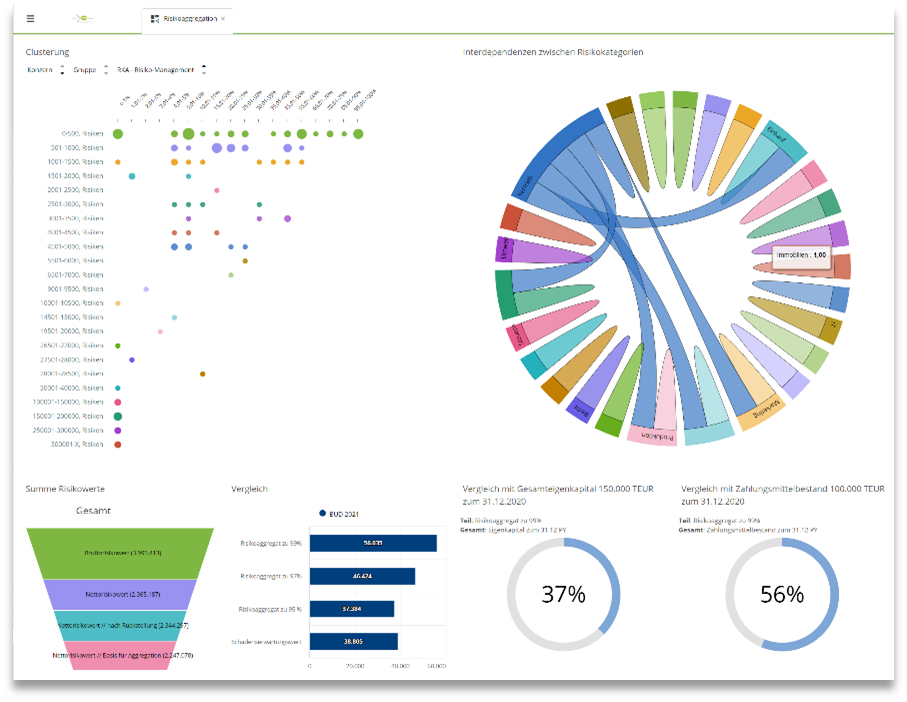

- Integrated risk management and controlling: The immediate effect of the crisis on the entire company and individual areas of the company is simulated. Crisis effects are estimated and commented on by each company department, their dependencies are shown, reported in a consolidated manner and joint measures can be taken (see Figures 1 & 2).

- Short-term liquidity is monitored and forecast.

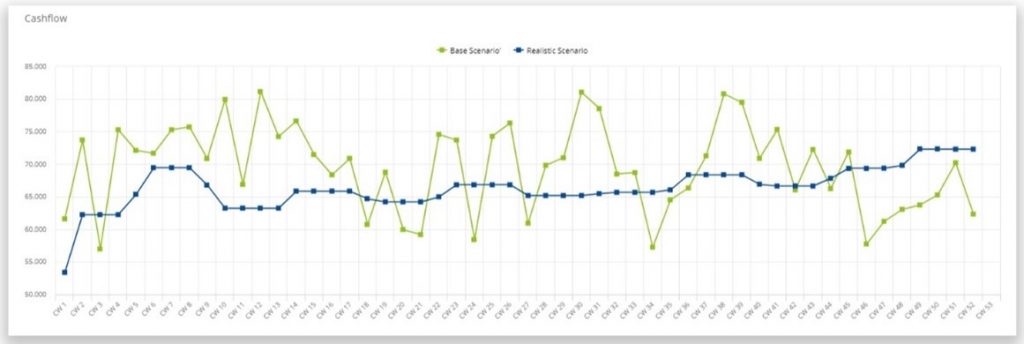

- Cash gaps can be bridged in the event of liquidity bottlenecks. Waterfall diagrams, delta markers, rolling forecasts, visualization of cash-in/out developments and highlighting of bottlenecks as well as the suggestion of financing alternatives are helpful here.

- Personnel costs are optimized. HR spend is forecast and what-if analyzes help with capacity planning. (see Figure 3)

- Sales can be stabilized or improved through special offers or campaigns. Bandwidth analyses, forecasts and scenario comparisons of initiatives are used to support this (see Figure 4).

- The impact of changes in demand on production/capacity is calculated and optimized. In addition to the automated production plan optimization, the effects of production downtimes on the cost structure are simulated.

- Integrated corporate planning provides the overall overview, in which all relevant information is brought together to support decision-making. Impact analyzes on the income statement, balance sheet and cash flow simulate the impact of the crisis on the entire company. (see figure 5 & 6)

All facts and dashboards for each of the 7 steps can be found in the white paper “Controlling in Times of Crisis” >>

You can find more information and a short video how to get crises under control on our crisis controlling knowledge platform >>

Do you have any questions about the crisis controlling system or other controlling topics? Simply select a suitable date for an expert discussion in our online calendar >>

We look forward to getting to know you