Professional and proactive management and development of real estate: The CREC System in 4 steps

This article addresses both traditional, regional housing real estate companies as well as internationally active companies and their extensive portfolios. It’s about the professional, proactive management and development of real estate. The “Real Estate 2020” initiative and voices from the field call for a stronger interlinking of CREC (Corporate Real Estate Controlling), resources and professional technologies in order to enable the holistic control and optimization of real estate portfolios.

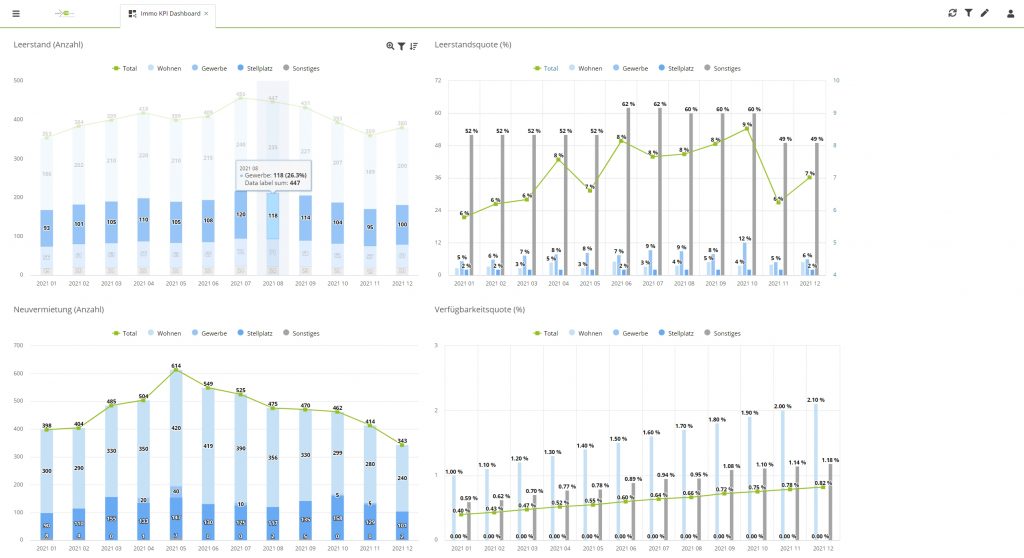

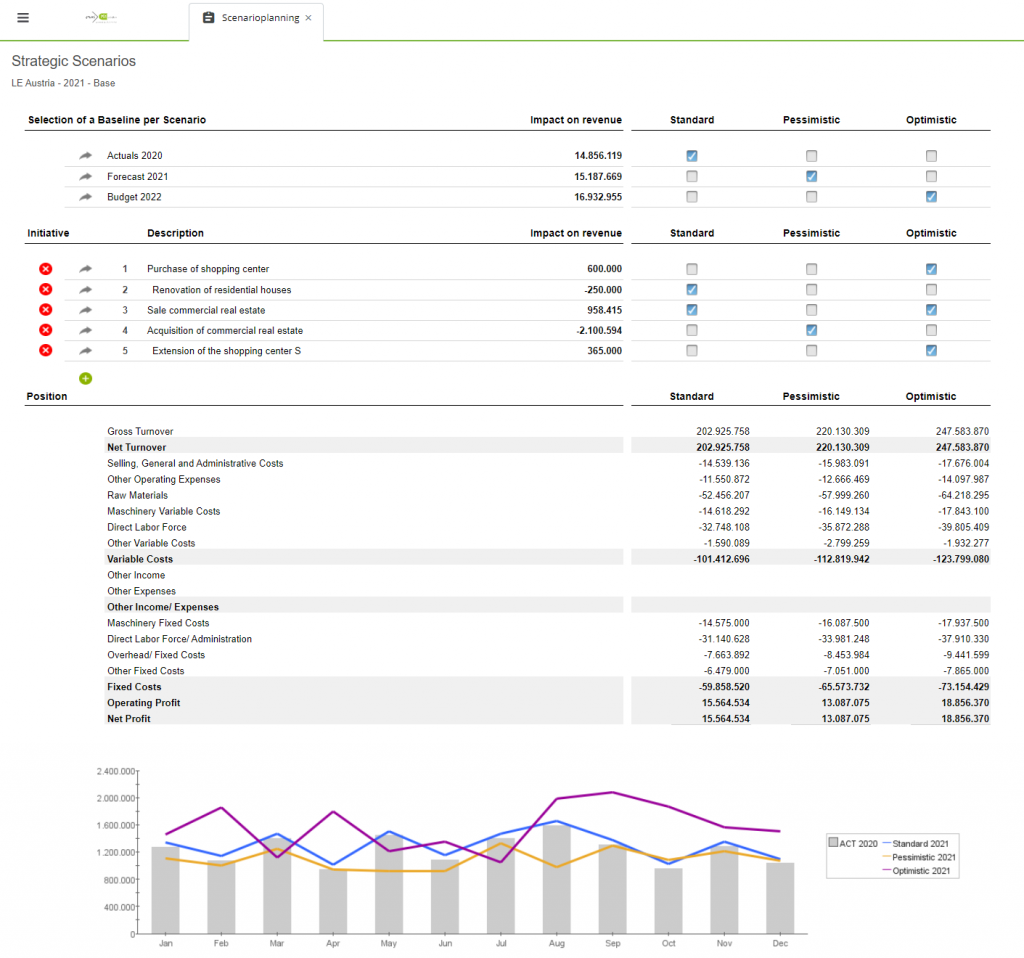

With a modern, technology-based CRECS – Corporate Real Estate Controlling System – real estate is continuously recorded on an integrated platform throughout its entire life cycle. The performance and risk of all buildings in the portfolio are continuously monitored and optimized using industry specific, predefined KPIs. Automated analyzes, dashboards, rolling forecasts and automated reporting relieve the controller when it comes to exhausting collection of all the information. Decisions can be supported reliably with what-if analyzes, value driver trees and scenario simulations, thus avoiding wrong decisions.

The benefits of the CRECS real estate controlling system from smartPM.solutions at a glance:

- Relief of manual, recurring activities of the controller, such as merging and sending data and Excel files.

- Single Point of Truth by connecting all legacy systems (ERP, CRM, etc.) and departments using standardized connectors.

- Support for investment decisions: scenario analyzes and what-if simulations based on daily updated data allow decisions that take into account all relevant value drivers. This makes it possible to determine the impact on the entire portfolio. S IMMO, for example, takes 50 value drivers into account in its scenario calculation.

- Real estate portfolio controlling: The portfolio is segmented, continuously monitored, and optimized in the portfolio matrix. A priority assessment is carried out for all buildings and the need for action is evaluated. Value enhancement measures such as revitalization, renovation, energetic refurbishment, etc. can be evaluated and decided. The smartPM real estate controlling solution (CRECS) also includes the modules building cost controlling (milestone trend analysis, AI-based execution time per construction phase, resource allocation, etc.) and project costing. Project budget ceilings allow budgets to be adhered to.

- Predefined, industry specific KPIs prepared in clear dashboards: vacancy rate, vacancy period, rent amounts and income, risk, LFL, WALT, IRR, LTV, total return, etc. Benchmarks are used to assess your own success compared to the overall market. Alarm and notification assistants help monitor developments.

- Rolling forecasts allow current developments to be considered. Machine learning algorithms / artificial intelligence make forecasts more precise. For example, future vacancies can be recorded and counteracted with appropriate measures.

- For initiatives to be effective, the integration of communication and collaboration tools (MS Planner, Teams, etc.) into the property controlling module enables the traceable allocation and tracking of tasks and their achievement of goals.

Figures 1 & 2: Dashboards of the smartPM Corporate Real Estate Controlling Solution: KPI Dashboard, Scenario Comparison based on market leading software-technology of Jedox, Unit4 FP&A/Prevero and Microsoft

Rely on a sparring partner and specialist knowledge

Real estate managers and controllers can rely on the experience and specialist knowledge of the smartPM consulting team. Many projects have produced a comprehensive, tried and tested real estate controlling tool that precisely covers the needs of the industry. Find out in the real estate controlling whitepaper – CRECS cleverly set up in 4 steps >>